Business reporter, BBC News

Getty Images

Getty ImagesThe Bank of England has cut UK interest rates from 4.25% to 4%, the lowest level since March 2023.

The Bank of England interest rate can affect mortgage rates and interest rates on savings, as well as the speed at which prices change and how the jobs market performs.

Here’s what that all means for you.

What the rate cut means if you have a mortgage

The Bank of England’s interest rate is what the central bank charges other banks that want to borrow money.

That then influences what interest rates those banks charge their customers for loans such as mortgages.

How the rate cut will affect mortgage repayments depends on the type of mortgage households have, and some could feel the difference quite quickly.

For those with a standard variable rate mortgage of £250,000 over 25 years, repayments will fall by £40 a month, according to financial information company Moneyfacts.

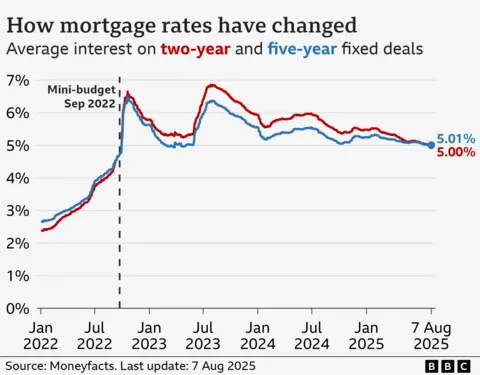

But most people with home loans have either a five-year or two-year fixed term mortgage. According to Moneyfacts, those interest rates have continued to fall, reaching 5.01% for five-year loans and 5% for two-year loans this month.

That will be little comfort to people coming off low five-year rates of below 3% soon, but welcome news for those re-fixing two-year rates which had been above 6% in August 2023.

What the rate cut means for your savings

While lower interest rates are good news for households with home loans, it is a different story for those with savings.

Rachel Springall, a finance expert at Moneyfacts, said the average savings rate is currently 3.5%, which is 0.42% lower than this time last year and is expected to keep falling. She said the average easy access ISA rate had also fallen by 0.46% over the year.

“Savings rates are getting worse and any base rate reductions will spell further misery for savers,” Ms Springall said.

How does it affect prices?

The Bank of England’s main job is to ensure the UK has a stable financial system.

One aspect of that is ensuring that prices for goods and services used by households and businesses do not rise too quickly.

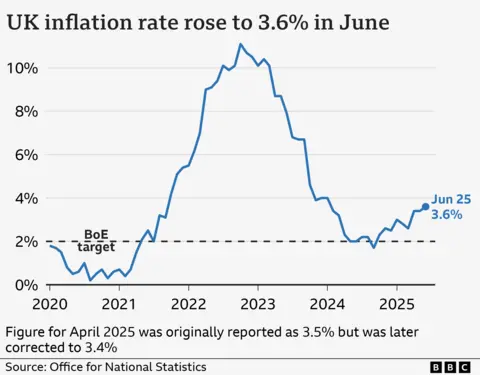

The Bank has a target to keep that increase in prices – known as inflation – at 2%.

If there is strong demand for goods and services, or a shortage of those things, prices can rise too fast. On the flip side, if there is weak demand, or an excess of goods or services, prices might not rise very quickly at all.

The Bank uses interest rates to try to keep inflation level. By lowering the interest rate, it encourages people with savings to spend their money rather than save it for later, while increasing interest rates makes saving money more attractive, reducing spending in the economy.

Inflation is currently 3.6% well above the Bank’s target rate – thanks in part to increased food prices.

According to its latest forecasts, the Bank expects inflation to increase slightly, reaching 4% by September.

While Bank of England governor Andrew Baily acknowledged the decision to cut rates was “finely balanced”, despite this higher level of inflation, one issue affecting the Bank’s decision was the jobs market.

Will it affect jobs?

Another aspect of the Bank’s remit to ensure the UK has a stable economy is monitoring the health of the jobs market.

Higher inflation affects business decisions, as it can increase operating costs.

This in turn can have an impact on hiring decisions, and recent figures show that the number of job vacancies has fallen, while the jobless rate has increased.

Businesses told the Bank that increases in National Insurance Contributions and the national living wage had added up to 2% to price rises, and they expected labour costs “to continue to push up food prices” through the rest of the year.

In order to mitigate those costs, businesses said they were having to cut staff.

The Bank said that a loosening in the jobs market would put some downward pressure on prices, helping to bring inflation down.